You have applied for a loan, found the perfect home, and had your offer accepted – life is good!

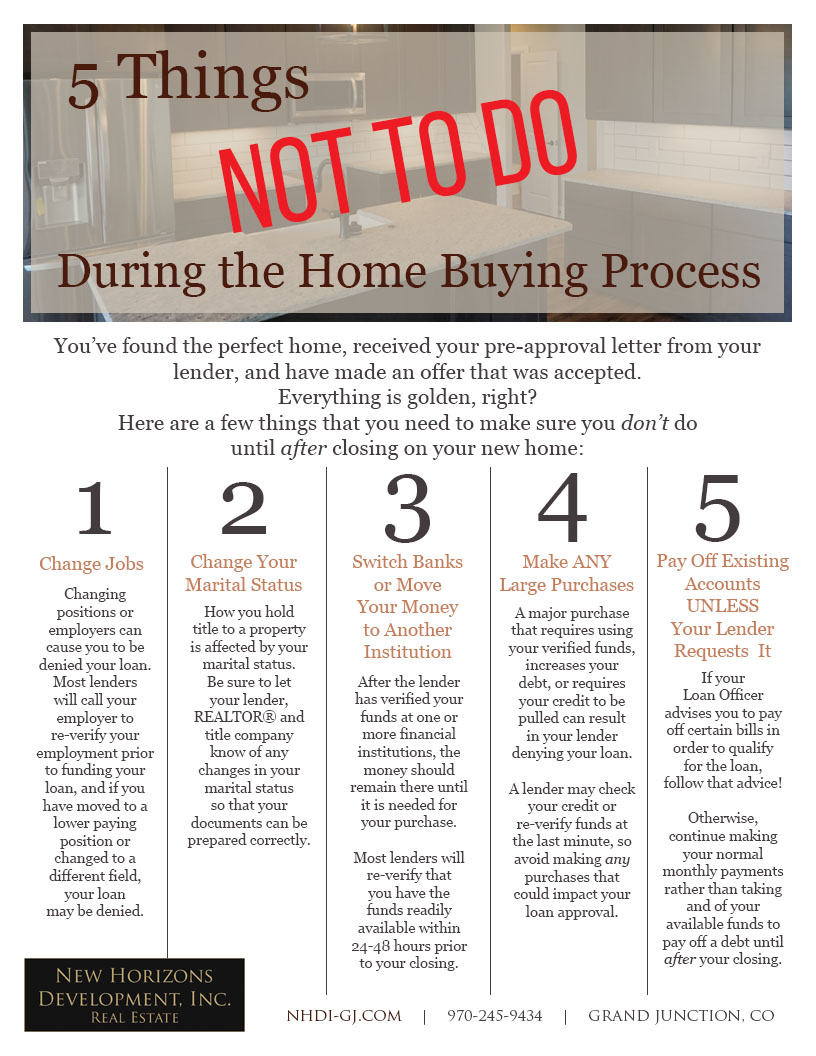

There are a few things that you need to avoid doing to make sure your loan application doesn’t get denied.

1. Don’t Change Jobs

Changing positions or employers can cause you to be denied your loan. Most lenders will call your employer to re-verify your employment prior to funding your loan, and if you have moved to a lower paying position or changed to a different field, your loan may be denied.

2. Don’t Change Your Marital Status

How you hold title to a property can be affected by your marital status. Be sure to let your lender, REALTOR® and title company know of any changes in your marital status so that your documents can be prepared correctly.

3. Don’t Switch Banks or Move Your Money to Another Institution

After the lender has verified your funds at one or more financial institutions, the money should remain there until it is needed for your purchase. Most lenders will re-verify that you have the funds readily available within 24-48 hours prior to your closing.

4. Don’t Make ANY Large Purchases

A major purchase that requires using your verified funds, increases your debt, or requires your credit to be pulled can result in your lender denying your loan. A lender will likely check your credit or re-verify funds at the last minute, so avoid making any purchases that could impact your loan approval.

5. Don’t Pay Off Existing Accounts UNLESS Your Lender Requests It

If your Loan Officer advises you to pay off certain bills in order to qualify for the loan, follow that advice! Otherwise, continue making your normal monthly payments rather than taking and of your available funds to pay off a debt until after your closing.

These are the major things on the What Not To Do list. Doing any of the above can cost you the ability to qualify for the loan on your new home – and that is NOT what we want!

Once you have begun the process of getting a loan, you need to relax, pay all of your bills on time, and not open any new lines of debt. Don’t go buy new furniture, and don’t pay down any debt unless your lender tells you that you need to for your approval.

Feel free to download & print this informational flyer!

This is part of our Buyer Tips series. Click Here for more Buyer Tips!